The report shows that global wearable device shipments reached a new high in the fourth quarter of 2021, reaching 171 million units, a year-on-year increase of 10.8%. Shipments for the full year were 533.6 million units, a year-on-year increase of 20.0%. For the growth in shipments, IDC attributes it to continued demand for health and fitness tracking devices and hearables.

According to two IDC reports, Morrison will analyze the market performance of the global TOP 5 and provide an outlook on the development trend of wearable devices in 2022.

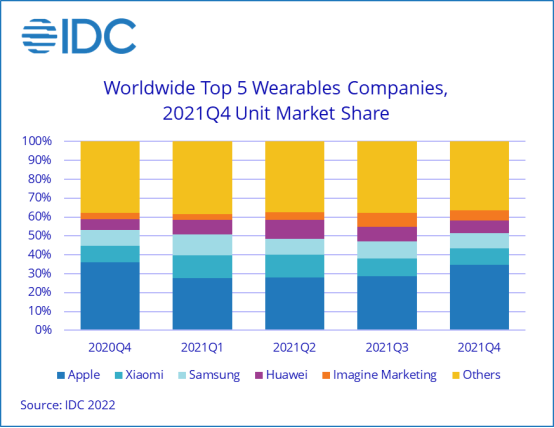

1. Global TOP 5 player performance: Apple dominates 30%, followed by Xiaomi, Samsung and Huawei.

Apple had a stable performance in the wearable market last year, with quarterly shipments of 59 million units, a year-on-year increase of 7.3%. Annual shipments were 161.8 million units, a year-on-year increase of 6.8%. In the fourth quarter, global shipments accounted for 34.9%, and annual global shipments accounted for 30.3%, and its dominance remained strong.

In September and October last year, Apple held two conferences in a row, successively launched the large-screen Apple Watch S7 and the cost-effective AirPods 3, and the Beats Fit Pro with a distinctive design was also launched in the quarter, jointly promoting Apple's shipments in the fourth quarter volume growth.

Xiaomi's fourth quarter and full-year shipments ranked second, with shipments of 14.6 million units and 54.4 million units, a quarterly increase of 7.9% year-on-year and a year-on-year increase of 7.1%.

As previously reported by Counterpoint, Xiaomi had a strong first half of 2021 with its Mi Watch Lite, while also releasing a new watch, the Redmi Watch 2 series, in the fourth quarter.

The third-ranked Samsung's fourth-quarter shipment growth rate tended to slow down, reaching 13.6 million units, a year-on-year increase of 3.8%, and its full-year shipments reached 48.1 million units, a year-on-year increase of 20.1%.

As we all know, due to the launch of two models of the Galaxy Watch4 series, Samsung began to explode in the third quarter, with a month-on-month growth of more than 200%, which directly drove the rapid growth of shipments throughout the year. However, in the past fourth quarter, it can be seen that its growth rate has slowed down significantly. If you want to continue to maintain rapid growth, you need to come up with more competitive products. Recently, it has been reported that Samsung's next-generation flagship watch, the Galaxy Watch, will be equipped with a temperature measurement function, and the battery life of the watch will be further improved.

Huawei’s shipments grew strongly in the fourth quarter, with 11.5 million units shipped, a year-on-year increase of 35.6%. The annual shipment was 42.7 million units, a year-on-year increase of 25.6%. Huawei's release of the Watch GT3 in the fourth quarter and the Watch Fit Mini in the European market helped its shipments more than double quarter-on-quarter despite ongoing sanctions from the U.S. government.

The fifth place is Indian company Imagine Marketing, which shipped 9.2 million units in the fourth quarter and 26.8 million units annually, with a quarterly and year-on-year growth of 69.6% and 163.4%. Due to the rapid growth of wearable devices in India, its well-known brand BoAt has grown rapidly in the mid-to-low-end market.

2. Chinese market performance: total shipments of 140 million units, with earphones accounting for 56%

2021 will be a year of recovery for the wearables market and a year of structural adjustment in the market. In the whole year, China's wearable market shipped nearly 140 million units, a year-on-year increase of 25.4%. In the fourth quarter, China's wearable device market shipped 37.53 million units, a year-on-year increase of 23.9%.

In this regard, IDC predicts that in 2022, China's wearable market shipments will exceed 160 million units, a year-on-year increase of 18.5%.

The annual market shipment of smart watches in China was 39.56 million units, a year-on-year increase of 21.4%.

Among them, the shipment of adult watches was 20.13 million units, a year-on-year increase of 31.0%. The rapid development of light smart watches represented by RTOS systems has played an important role in driving the watch market. At the same time, although there have been major changes in the competitive landscape of manufacturers, the overall situation in which Huawei and Apple are leading the way is still continuing.

Shipments of children's watches reached 19.43 million units, a year-on-year increase of 12.8%. Compared with 2020, the children's market has obvious signs of recovery, but it still faces challenges and bottlenecks due to the slowdown in the growth of the potential user base and product homogeneity.

In 2021, the wristband market will ship 19.1 million units, a year-on-year decrease of 26.3%. Mainly due to the influence of manufacturers' strategies, market demand and price fluctuations, the wristband market has experienced a significant decline.

It is reported that from 2020 to 2021, the average price of the bracelet market will increase from $27 to $34. On the one hand, the market demand for bracelets is affected by rising prices, and on the other hand, it is restrained by limited wearing functions. And manufacturers are gradually inclined to watch products with higher user retention and profit in the product strategy of wearable devices.

Looking forward to 2022: Pursuing sports health, home furnishing linkage, or returning to fashionable wear?

1. The application of sports health sensing technology plays an important role in driving market demand

Sports-related functions such as heart rate, blood oxygen, and exercise mode monitoring have developed to a certain stage. In-depth exploration of sensing technology and applications in health scenarios in the future, such as blood pressure, blood sugar and other indicator monitoring capabilities, will play an important role in driving market demand. , and also laid the foundation for the iteration of the wearable market.

2. Appearance aesthetics and brand symbols are higher requirements for the development of wearable devices

Whether smart watches can further replace traditional watches is closely related to their appearance design and brand symbolic attributes. It is also the key for wearable watches to break the limitations of sports and health scenarios and further expand the potential user population.

IDC research data shows that in 2021, 16% of users will buy wearable watches for fashion decoration; nearly 80% of users will still wear their traditional watches after purchasing wearable watches, of which 24% of Traditional watches are still often worn.

3. Combine with IoT to further expand the boundaries of wearable devices

The automated and personalized operation of smart home devices will also further leverage the personal and portable advantages of wearable devices.